1,027 Views

All through historical past, few issues have been as universally acknowledged and dependable as gold. Folks flip to gold once they’re fearful about issues like inflation, financial issues, or conflicts. However for these used to purchasing and promoting shares and bonds on-line, stepping into gold might be robust. Not like digital belongings, shopping for gold means coping with actual folks and determining the place to retailer it safely. It’s a distinct sport that requires cautious planning and understanding to do it proper.

The first avenues for investing in bodily gold embrace bullion, cash, and jewelry, every with its personal set of issues and potential pitfalls.

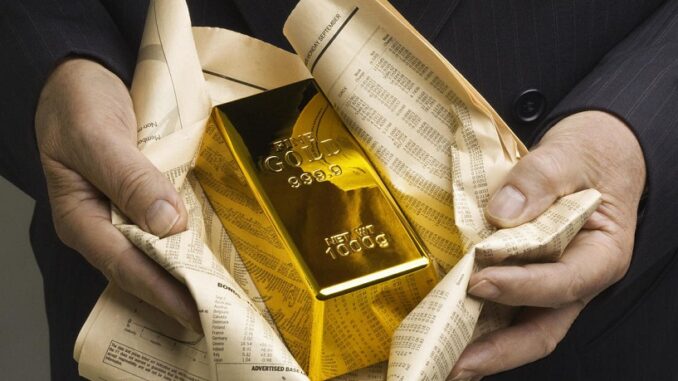

Gold Bullion Bars

Bullion, sometimes envisioned as giant, gleaming bars securely housed in vaults, gives an easy technique of gold possession. These bars are available in varied sizes, starting from just a few grams to a considerable 400 ounces, with one- and ten-ounce bars being essentially the most prevalent. Nevertheless, given the substantial worth of gold, buyers should train warning, making certain they interact with a good gold seller and organize for safe supply or storage to guard their funding.

Gold bullion cash

Gold cash supply an easier manner of investing in valuable metals. You’ll find them in numerous sizes, like one or two ounces, and a few gold sellers even have smaller ones, like half-ounce or quarter-ounce cash. Cash reminiscent of South African Krugerrands, Canadian Maple Leafs, and American Gold Eagles are well-known and simple to commerce. However their costs won’t solely depend upon how a lot gold they’ve.

Collectible cash, specifically, usually command premiums above their gold content material as a consequence of components like rarity and historic significance. Due to this fact, it’s essential for buyers to rigorously take into account their choices earlier than making a purchase order. Whereas native markets or collectors could supply doubtlessly higher offers, the safety supplied by coping with licensed sellers can’t be overstated.

Gold jewelry

Investing in gold jewelry introduces a further layer of complexity and danger in comparison with bullion or cash. Whereas wearable gold jewelry holds intrinsic worth and aesthetic enchantment, buyers should train warning to make sure authenticity and purity. Not like bullion or cash, the place the worth is primarily decided by the gold content material, jewelry costs could embrace important mark-ups primarily based on design and producer, doubtlessly exceeding 3 times the uncooked worth of the gold. Understanding the purity of the jewelry, sometimes measured in karats, is important, as decrease purity ranges diminish the jewelry piece’s soften worth.

Whereas gold jewelry is usually a type of funding, it’s not all the time essentially the most environment friendly one. It’s smart to think about diversifying your investments past simply bodily belongings like gold jewelry.

In conclusion, investing in bodily gold gives buyers a novel alternative for diversification and safety in opposition to financial uncertainty. Whether or not by way of bullion, cash, or jewelry, people should rigorously weigh the advantages and dangers related to every possibility. Whereas gold has traditionally served as a protected haven asset in instances of turmoil, thorough analysis, engagement with respected gold sellers , and a nuanced understanding of pricing, purity, and storage issues are crucial for fulfillment within the bodily gold market. By navigating these complexities successfully, buyers can doubtlessly capitalize on gold’s enduring attract whereas safeguarding their monetary future in opposition to turbulent instances.